Supervised learning on Google stock analysis and predictions

Abstract

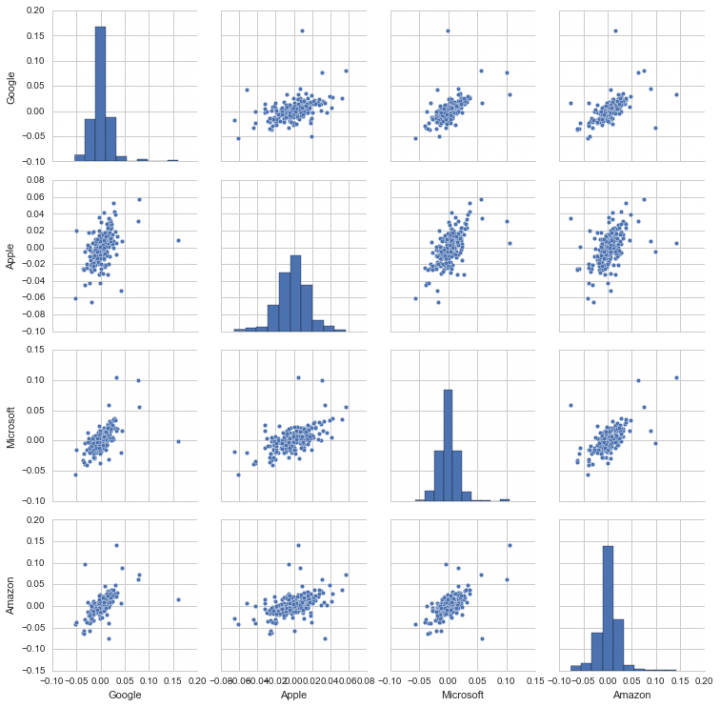

We study some tech stock price through data visualization and some financial technique, focusing on those which are intended to give a sort of reliable prevision to permit brokers have a basis on which they could decide when it is the best moment to sell or buy stocks. We first analyze a year of data about the biggest companies as Amazon, Google, Apple and Microsoft but right after that we focus on Google stocks.

Next we leave the financial tools for supervised learning analysis. These machine learning processes learn a function from an input type to an output type using data comprising examples. Furthermore we’ll talk specifically of regression supervised learning, meaning that we’re interested in inferring a real valued function whose values corresponds to the mean of a dependant variable (stock prices).

We first applied linear regression on the last 6 years of Google Trends about the word ‘google’ specifically searched in the financial news domain, versus the last 6 years Google stock prices. From now on we change our feature domain with a multivariate input, i.e. we use other stock prices (AAPL, MSFT, TWTR, AMZN) to study the accuracy of others algorithms such as a multivariate linear regression, a SVR and a Random Forest.

keywords : Finance, Stock Price Analysis, MACD, Machine Learning, Linear Regression, SVR, Random Forest, Data Visualization, Python, R

- Have a look at the work through nbviewer (it fails to load images from folders, to do it download the project and open it in the jupyter notebook)

- go to GitHub

What to do next ?

- Do you see any error? Please tell me what to correct and why;

- Implement these algorithms on other stocks and compare results

- Add the r sqared to the RMSE comparison

- Try to predict future stocks prices instead of contemporary ones

Lascia un commento